BLOGS

19 Dec 2025

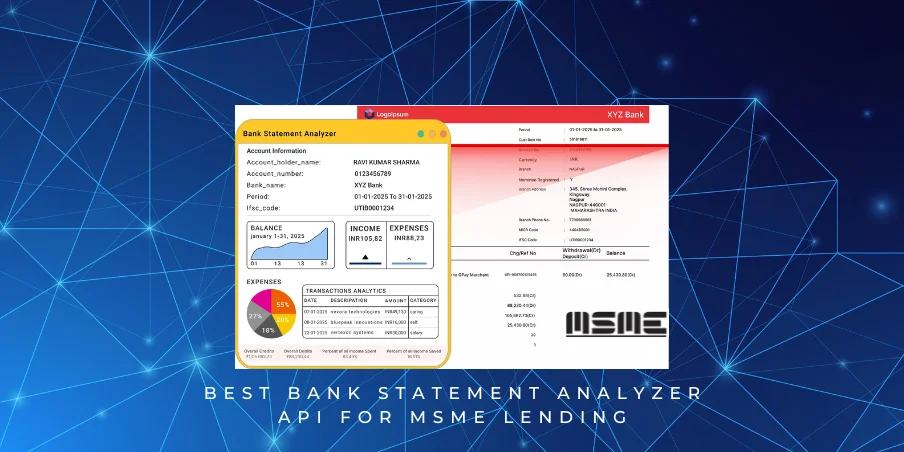

Best Bank Statement Analyzer API for MSME Lending: Automating Underwriting Workflows in 2026

Why MSME Lending Needs Automation in 2026

Best Bank Statement Analyzer API for MSME Lending is becoming a game-changer for lenders who want to grow their small business portfolios without drowning in manual work or taking on unnecessary risk. MSMEs drive India’s economy, but lending to them has always been tough—business cash flows are rarely as clean and predictable as a salaried employee’s paycheck.

The biggest headaches come from old-school manual reviews. Credit teams spend days poring over bank statements that mix personal and business transactions, trying to separate genuine revenue from owner draws, spotting seasonal patterns, or catching padded inflows. Data is inconsistent—one business uses multiple accounts, another has vague UPI narrations, and statements arrive as blurry scans or mismatched formats. All this leads to slow decisions, high operational costs, frustrated borrowers, and sometimes loans that go bad because something important got missed in the rush.

That’s why bank statements remain the backbone of MSME underwriting.

They show the real day-to-day cash movement—inflows from customers, outflows for suppliers, rent, salaries—that bureau scores or GST returns alone can’t capture fully. A healthy business account tells you if revenue is steady (or seasonal), if there’s enough surplus after expenses, and whether the owner is drawing sustainably.

Heading into 2026, AI-driven underwriting workflows are finally mature enough to handle this complexity at scale. Advances in OCR, natural language models tuned to Indian banking language, and machine learning trained on millions of real business statements mean automation isn’t just faster—it’s often more accurate than manual checks for spotting patterns and risks.

Lenders need this shift now more than ever. MSME loan demand is surging with digital platforms and government push, but margins are tight and defaults hurt fast. The Best Bank Statement Analyzer API delivers the speed, consistency, and depth that turns slow, risky MSME underwriting into a competitive advantage.

In this practical guide, you’ll learn:

- What Is a Bank Statement Analyzer API for MSME Lending?

- How MSME Loan Underwriting Traditionally Works (And Why It Fails)

- How the Best Bank Statement Analyzer API Automates MSME Underwriting

- Core Features Required for MSME Lending (2026 Checklist)

- Key MSME Credit Metrics Extracted by AI APIs

- Use Cases Across MSME Loan Products

- Benefits of Using the Best Bank Statement Analyzer API

- Compliance, Security & RBI Readiness

- Build vs Buy: Why APIs Win for MSME Lending

- Why AZAPI.ai Is Among the Best for MSME Lending

- Accuracy Benchmarks in 2026

- Common MSME Statement Challenges & AI Solutions

- How to Choose the Best Bank Statement Analyzer API

- Conclusion

- FAQs

Whether you’re a bank scaling your MSME book, an NBFC targeting specific trades, or a fintech building embedded lending, tools from forward-thinking providers like AZAPI.ai can help you approve more viable businesses faster—while keeping risk firmly under control. Let’s dive in.

What Is a Bank Statement Analyzer API for MSME Lending?

If you’re lending to small businesses, you’ve probably realised that the tools built for salaried personal loans just don’t cut it for MSMEs. A bank statement analyzer API tailored for MSME lending changes that—it’s a specialised cloud service that takes raw bank statements and turns them into clear, actionable business insights fast.

1. Definition & Core Purpose

At its simplest, a bank statement analyzer API ingests statements in any format (PDFs, scans, Excel, images), extracts every transaction, makes sense of the chaos, and delivers structured data plus key business metrics. It goes way beyond basic OCR—it classifies inflows as sales, merchant settlements, or platform payouts; separates expenses like vendor payments, rent, or utilities; calculates turnover, cash flow health, and risk signals; and flags anything suspicious.

The core purpose for MSME lending? Give you an accurate picture of the business’s real operating cash flow and repayment capacity in minutes, instead of days of manual work. This lets you underwrite working capital, term loans, or invoice financing with confidence, even when bureau data or GST returns are limited or outdated.

The big difference from salaried borrower analysis is complexity. For salaried loans, you mostly look for steady salary credits, fixed EMIs, and personal spending patterns—one clean income stream dominates. MSME statements are messier: income is irregular, spread across multiple sources (customers, platforms like Amazon/UPI, cash deposits), and often mixed with personal transactions. A generic bank statement analyzer API might mislabel business revenue as “other credits,” but one built for MSME lending knows how to spot and validate genuine turnover patterns.

2. Why MSME Underwriting Is More Complex

Small business bank accounts rarely look tidy, and that’s why traditional tools struggle.

Multiple accounts:

Many owners use separate current accounts for business, savings for personal, or even family accounts. Good APIs can analyse multiple statements together to build a consolidated view.

Irregular income:

Unlike monthly salaries, revenue comes in lumps—big customer payments one week, nothing the next, or seasonal spikes (festive sales for retailers, harvest cycles for agri-linked businesses). The API has to detect patterns over 6–12 months to assess true average turnover and stability.

Cash-heavy transactions:

Lots of cash deposits/withdrawals are common, especially in retail, trading, or service businesses. This makes tracking actual sales harder and raises questions about undeclared revenue or laundering risks—smart APIs score cash dependency and cross-check patterns.

Business vs personal mixing:

Owners often pay personal expenses (groceries, school fees) or draw salary from the business account. The best systems separate these intelligently, estimating sustainable owner draw vs operational costs, so you lend against business health, not inflated personal spending.

In short, a proper bank statement analyzer API for MSME lending isn’t just faster—it’s built to handle the real-world messiness that makes small business underwriting so challenging. It turns noisy statements into reliable signals, helping you say yes to more viable businesses while protecting your portfolio.

How MSME Loan Underwriting Traditionally Works (And Why It Fails)

Even in 2026, many banks and NBFCs still underwrite MSME loans the old-fashioned way. It’s a process that feels familiar but is increasingly painful to watch—and it’s exactly why the Bank Statement Analyzer API is becoming non-negotiable for lenders who want to grow profitably.

1 Manual Workflow Breakdown

Here’s what the traditional process typically looks like:

Statement collection

Borrower uploads or emails statements (often multiple accounts, 6–12 months). Credit officers chase missing months, ask for clearer scans, or reject blurry PDFs outright. It already takes days just to gather everything.

Spreadsheet analysis

Once collected, statements are dumped into Excel. Analysts manually tag each transaction: “This is sales credit,” “This is rent,” “This looks like owner draw.” They calculate average turnover, subtract expenses, check for bounces, and try to spot red flags like sudden spikes or cash-heavy patterns. One statement might take 30–60 minutes; a complex business with multiple accounts can take hours.

Credit officer dependency

The entire decision rests on the analyst’s judgment. They decide what’s “business income” vs personal, whether seasonality is normal, or if cash deposits look suspicious. No two officers see the same statement the same way—consistency suffers.

2 Key Problems

This old-school approach is breaking under pressure for several reasons:

Long TAT (days/weeks)

From application to disbursement, it often takes 7–30 days just for the statement review. Borrowers get frustrated and go to competitors offering faster approvals. In a world where working capital is needed yesterday, this delay kills conversions.

Human bias

Decisions vary by officer—some are more lenient on cash deposits, others flag every irregularity. Personal impressions (branch location, borrower’s appearance, even name) creep in. This leads to inconsistent approvals and higher risk of bad loans.

Scaling limitations

As MSME loan applications grow (especially post-government schemes and digital push), you can’t just hire more analysts. The team becomes the bottleneck, costs explode, and quality drops as staff are stretched thin.

High operational costs

Analyst salaries, training, spreadsheet tools, back-and-forth with borrowers, and rework from errors add up fast. Many lenders spend 40–60% of their credit ops budget just on manual statement checking—money that could be better used elsewhere.

The bottom line: traditional manual MSME underwriting is slow, inconsistent, expensive, and doesn’t scale. In 2026, lenders who keep doing it this way will lose market share to those using the Best Bank Statement Analyzer API for MSME Lending—tools that automate the heavy lifting, deliver consistent results, and let credit teams focus on real judgment calls instead of data entry.

Automation isn’t a luxury anymore—it’s the only way to keep up with the volume and speed MSME borrowers now demand.

How the Best Bank Statement Analyzer API Automates MSME Underwriting

One of the biggest reasons lenders are adopting the Bank Statement Analyzer for MSME Lending is how cleanly it automates a process that used to be full of manual steps and bottlenecks. Instead of credit officers chasing documents and crunching numbers in spreadsheets, the API handles the heavy lifting end-to-end, delivering consistent, ready-to-use insights in minutes.

1 End-to-End Workflow Automation

The flow is straightforward and feels almost seamless once integrated:

- Upload: Borrower submits statements through your app, portal, or even Account Aggregator (one or multiple accounts, any format—PDFs, scans, Excel). No more chasing for “clearer copies.”

- OCR: The API instantly digitizes the content, pulling text from even poor-quality scanned PDFs or mobile photos with high accuracy.

- Categorization: Every transaction gets intelligently tagged—sales credits, merchant settlements, vendor payments, rent, utilities, owner draws, cash withdrawals, UPI inflows, etc. Business and personal flows are separated automatically.

- Risk Scoring: Key metrics are calculated (turnover, net cash flow, seasonality, bounces), fraud signals checked (round-tripping, fake inflows), and an overall risk profile generated.

- Decision: Structured output feeds directly into your rules engine or LOS for auto-approval, escalation, or rejection. High-confidence cases can go straight through; borderline ones flag for quick human review.

The whole thing often wraps up in under a minute per application, turning what took days into near-real-time underwriting. This is how forward-thinking NBFCs are pushing disbursals same-day or next-day without adding headcount.

2 AI Components Involved

What makes this possible is a stack of specialised AI working together:

- OCR for scanned PDFs: Advanced optical character recognition that goes beyond basic text grabbing—it enhances images (deskew, denoise, boost contrast) and reads tables accurately, even on blurry or multi-page scans common from branch printouts.

- NLP for narration understanding: Natural language processing trained on Indian bank narrations deciphers the chaos—”IMPS CR – CUST PAYMENT XYZ,” “UPI/DR/AMZN,” or cryptic codes—and figures out the real meaning (customer sale, platform payout, supplier payment).

- ML for pattern recognition: Machine learning models look across months or years to detect trends—seasonal revenue spikes, consistent vendor payments, gradual growth, or worrying signs like declining inflows or increasing cash dependency.

3 Rule Engine + AI Hybrid Model (2026 Best Practice)

Pure AI is powerful, but the smartest setups in 2026 combine it with a flexible rule engine—this hybrid approach is now considered best practice for MSME lending.

You keep the AI’s strength in handling messy, unstructured data and spotting subtle patterns, but layer on lender-specific credit rules like:

- Minimum average monthly turnover thresholds by industry

- Maximum acceptable cash dependency percentage

- Bounce limits or negative month tolerances

And policy-based overrides for your unique guidelines:

- Auto-approve if turnover > ₹5 lakh and bounces = 0

- Escalate if seasonality score indicates agri-linked business (for special schemes)

- Reject if fake inflow confidence is low

This way, the Best Bank Statement Analyzer API for MSME Lending delivers the speed and intelligence of AI while staying fully aligned with your credit policy—no black-box decisions, just transparent, controllable automation that scales with your business.

Core Features Required for MSME Lending (2026 Checklist)

By 2026, a solid bank statement analyzer API for MSME lending has to deliver more than just basic data pulling. It needs to understand the unique realities of small business accounts—irregular inflows, mixed transactions, seasonality—and turn them into reliable underwriting signals. Here’s the essential checklist of features every serious lender should demand.

1 Business Income Identification

Getting revenue right is the starting point, and generic tools often fall short here.

- Sales credits: Spotting direct customer payments through NEFT, IMPS, RTGS, or UPI, even with varying narrations.

- Merchant settlements: Aggregating bulk payouts from gateways like Razorpay, Paytm, or Pine Labs.

- Platform payouts: Recognizing credits from e-commerce marketplaces (Amazon, Flipkart) or gig apps, which usually land as lumped monthly transfers.

The API should normalize these into a clean average monthly turnover figure you can trust.

2 Expense & Obligation Analysis

Outflows tell you if the business can actually service debt after covering operations.

- Vendor payments: Identifying supplier debits, often recurring or in large batches.

- Rent & utilities: Fixed overheads that drain cash consistently.

- EMI & credit obligations: Existing loan repayments, credit card dues, or BNPL commitments—critical for calculating true debt burden against business revenue.

3 Cash Flow & Stability Metrics

MSME health shows up in trends, not single-month snapshots.

- Monthly net cash flow: Total inflows minus outflows, tracked across the statement period.

- Revenue consistency: How steady credits are month-to-month (or if volatility is explainable).

- Seasonality detection: Recognizing predictable spikes and dips—festive surges for retailers, harvest-linked patterns for traders—so you don’t penalize normal business cycles.

These give a realistic view of surplus available for new repayments.

4 Risk & Fraud Signals

Protecting the portfolio means catching problems early.

- Round-tripping: Credits quickly followed by matching withdrawals to artificially boost balances.

- Sudden balance spikes: Large unexplained deposits without supporting activity.

- Fake inflow detection: Padded credits that lack real sales patterns (repeated round amounts, same-source loops).

Good APIs assign confidence scores to these flags, letting you auto-escalate suspicious cases.

In short, these features are what make Best Bank Statement Analyzer API for MSME Lending truly effective for MSME lending in 2026. They turn noisy, mixed business statements into clear, consistent insights—helping you approve more genuine enterprises confidently while keeping defaults and fraud in check. Skip any of these, and you’re still stuck with half-automated, risky underwriting.

Key MSME Credit Metrics Extracted by AI APIs

The real value of Best bank statement analyzer API for MSME lending shows up in the metrics it delivers. These aren’t just random numbers—they’re the standardized, objective figures that feed directly into your credit models, replacing hours of spreadsheet calculations with consistent, ready-to-use insights.

Here’s the core set of MSME underwriting metrics that top APIs extract reliably in 2026:

Average Monthly Turnover

The normalized monthly business revenue after identifying and aggregating sales credits, merchant settlements, and platform payouts. This is your primary indicator of business size and capacity—far more accurate than self-declared figures.

Business Vintage

How long the account has shown consistent business-like activity (regular credits, operational debits). Older vintage generally signals stability, while newer accounts might need extra checks or lower exposure.

EMI to Turnover Ratio

Total existing monthly debt obligations (EMIs, credit card dues, BNPL) divided by average monthly turnover. Lenders typically want this under 30–40% for comfort—higher ratios mean the business is already stretched and less able to take on new debt.

Cash Dependency Score

The percentage of revenue coming through (or expenses going out as) cash deposits/withdrawals versus digital transactions. High cash dependency can indicate informal operations, harder-to-verify income, or potential risks—many lenders cap exposure or charge higher rates when this score is elevated.

Bounce Frequency

Count of inward/outward cheque returns, failed standing instructions, or insufficient-funds events over the analyzed period. Even a few bounces signal cash flow stress and are strong predictors of future repayment issues.

Negative Month Count

Number of months where net cash flow (inflows minus outflows) was negative. Occasional negative months might be normal (seasonal lulls), but frequent or consecutive ones highlight structural cash shortages that make repayment risky.

These business loan credit metrics give you a balanced, data-driven view of viability: size (turnover), stability (vintage, consistency), burden (EMI ratio), transparency (cash dependency), and stress signals (bounces, negative months). When extracted consistently by a reliable API, they let you apply the same thresholds across thousands of applications—no more analyst debates or overlooked risks.

For growing MSME portfolios in 2026, having these metrics delivered accurately and instantly is what separates scalable, profitable lending from the old manual grind.

Use Cases Across MSME Loan Products

The Best bank statement analyzer API for MSME lending adapts to different MSME products, handling their specific cash flow needs and risks. Here’s how it works for key ones in 2026.

1 Working Capital Loans

Quick funds for daily operations. The API assesses turnover, net cash flow, and seasonality from statements, sizing limits accurately and enabling approvals in hours—ideal for traders or retailers needing inventory boosts.

2 Term Loans

For expansion or machinery (3–5 years). It checks long-term revenue consistency, EMI burden, and stability over 12+ months, giving confidence for larger exposures in manufacturing or services.

3 Invoice Financing

Discounting unpaid bills. The API verifies recurring buyer credits matching invoices, spotting payment patterns or delays—allowing higher advances with lower risk for B2B suppliers.

4 Merchant Cash Advance

Daily-remittance advances for retail/hospitality. It analyzes daily sales (POS/UPI) to forecast revenue and set affordable deductions based on actual volatility.

5 Supply Chain Finance

Anchor-led programs for suppliers. The API confirms anchor payments, cash cycle health, and dependency risks—enabling reverse factoring to strengthen the chain.

In all these MSME loan use cases, business lending automation via statements cuts TAT, improves accuracy, and scales approvals—turning a tricky segment into profitable growth.

Benefits of Using the Best Bank Statement Analyzer API

Adopting the Best Bank Statement Analyzer API for MSME Lending isn’t just about adding tech—it’s about fixing real problems that hold back growth in small business financing. The wins show up quickly for everyone involved.

1 For NBFCs & Banks

- Faster approvals (minutes vs days) What used to take a week or more—collecting statements, manual tagging, spreadsheet crunching—now happens in minutes. Applications move through underwriting fast, boosting conversion rates and letting you book more loans without losing borrowers to slower competitors.

- Reduced credit ops cost Manual analysis is expensive: analyst time, rework from errors, chasing documents. Automation cuts this dramatically—fewer staff needed for the same (or higher) volume, lower error rates, and less back-and-forth. Many lenders see 40–60% drops in per-loan processing costs.

- Higher approval confidence Consistent, data-driven insights replace varying analyst judgment. You get objective metrics on turnover, cash flow stability, and risk flags, leading to better risk pricing, fewer defaults, and the ability to safely approve businesses that looked borderline manually.

2 For MSME Borrowers

- Less documentation No endless requests for extra months, clearer scans, or explanations. The API handles messy uploads accurately the first time, so borrowers submit once and move on.

- Faster disbursals Funds hit accounts in hours or next-day instead of weeks—critical when a retailer needs inventory before peak season or a manufacturer has a supplier payment due.

- Better loan experience The process feels modern, transparent, and respectful of their time. Quick decisions build trust, increase repeat business, and turn satisfied owners into referrals.

Overall, the Best Bank Statement Analyzer API levels the playing field: lenders grow MSME books profitably and at scale, while small businesses get the working capital they need without the usual hassle. In 2026, it’s one of those upgrades that pays for itself fast.

Compliance, Security & RBI Readiness

When you’re dealing with small business owners’ bank statements, you can’t take chances with compliance or security. One wrong move and you’re looking at RBI headaches, lost trust, or worse. That’s why any bank statement analyzer API worth using in 2026 has this stuff baked in properly.

- Regulatory Alignment It has to follow RBI’s digital lending rules to the letter—no funny business with data usage or borrower treatment. Everything comes with full audit trails: who uploaded what, when it was processed, and how the insights were built. Makes life easier when regulators come knocking or you need to check something internally.

- Data Security Protection is serious: strong encryption (the kind banks use) for data sitting around and moving between systems. Logins happen through proper secure methods like OAuth or rotating API keys. Access is tightly controlled—only the right people or systems see what they need, nothing more.

- Explainable AI No mysterious black-box scores. The API shows clearly why something got flagged—like “high risk because of three bounces and heavy cash withdrawals”—with straightforward reasoning. This keeps decisions defensible if RBI asks questions or a borrower disputes something.

Bottom line: good compliance and security aren’t extras—they’re what let you automate MSME lending without sleepless nights. Pick a provider that gets this right, and you can scale confidently knowing your back is covered.

Build vs Buy: Why APIs Win for MSME Lending

Many lenders initially think about building their own statement analyzer, but for most, buying a ready bank statement analyzer API is the smarter move—especially for complex MSME underwriting.

1. In-House Challenges

- Constant bank format changes Indian banks tweak PDF layouts, narrations, and structures frequently. Keeping an in-house system updated is a never-ending chase.

- OCR accuracy issues Achieving reliable extraction on real-world scans, regional fonts, and mixed statements demands massive training data and ongoing tuning—hard and expensive to get right.

- Maintenance burden You end up with a full team handling servers, model retraining, security patches, compliance updates, and bug fixes—diverting focus from your core lending business.

2. Advantages of Ready APIs

- Faster go-live Integrate in weeks instead of months or years—no need to build from scratch.

- Proven accuracy Providers have already trained on millions of Indian statements, delivering high performance on messy MSME data from day one.

- Continuous upgrades New bank formats, better models, fraud patterns—all handled by the vendor. You just get the improved version automatically.

For almost every bank or NBFC, the API route saves time, money, and headaches while letting you scale MSME lending faster and safer. Build only if statement analysis is your core competency—otherwise, buy and focus on what you do best.

Why AZAPI.ai Is Among the Best for MSME Lending

When lenders shop for a bank statement analyzer API that truly handles the complexities of Indian MSME lending, AZAPI.ai consistently comes out near the top. It’s built specifically for this market, focusing on the things that matter most: accuracy on local statements, deep business insights, flexibility, and the ability to handle serious volume without breaking.

Here’s what makes it stand out.

- High-accuracy OCR for Indian bank statements Indian statements are notoriously tough—password-protected PDFs, blurry branch scans, regional fonts, mixed languages. AZAPI.ai’s OCR with 99.91% accuracy is tuned on vast amounts of real Indian data, delivering reliably high extraction rates even on poor-quality mobile uploads. Fewer errors mean less manual cleanup and more trust in the downstream metrics.

- Advanced MSME cash-flow modeling It doesn’t stop at basic categorization. The platform separates business and personal flows intelligently, detects seasonality, estimates true operational turnover, and models net cash flow with nuance—spotting sustainable surplus after vendor payments, rent, and owner draws. This gives a far more realistic picture of repayment capacity than generic tools.

- Custom underwriting rules Every lender has their own credit policy. AZAPI.ai lets you layer custom rules easily—thresholds for cash dependency, bounce tolerance, minimum turnover by industry, or special checks for trades like retail or manufacturing. You keep the AI’s smarts but ensure outputs align perfectly with your risk appetite, no heavy coding required.

- Scales for high-volume NBFCs Built on robust cloud infrastructure, it handles thousands of statements daily without slowdowns—critical during peak seasons or campaigns. Processing stays fast and consistent, with strong uptime and high-availability design, so your approval flows don’t stall when applications surge.

In a crowded field, AZAPI.ai earns its spot among the best by staying laser-focused on Indian MSME realities: tough data, complex cash flows, RBI compliance, and the need for speed at scale. For banks and NBFCs looking to grow their small business portfolios profitably in 2026, it’s a practical, dependable choice that delivers results without unnecessary complexity.

Common MSME Statement Challenges & AI Solutions

MSME bank statements are rarely clean and simple—that’s what makes manual underwriting so frustrating. Borrowers run personal expenses through business accounts, rely heavily on cash, use regional banks, and often submit blurry scans. A good bank statement analyzer API tackles these head-on, turning problems into reliable insights.

Here’s the most frequent challenges and how modern AI solves them.

- Mixed personal/business accounts Owners pay groceries, school fees, or even family transfers from the business account. Manual analysts waste hours guessing what’s operational vs personal. AI solutions intelligently separate flows: recurring vendor/rent payments and sales credits get tagged as business; irregular small debits to known personal categories (dining, fuel, shopping) as owner draws. It estimates sustainable draw levels and focuses underwriting on true business surplus.

- Cash deposits Many traders, retailers, or service businesses deposit daily cash sales. This makes revenue hard to verify and raises questions about undeclared income or risks. AI correlates cash deposits with patterns—consistent daily/weekly amounts matching sales cycles get accepted as legitimate; erratic large lumps trigger flags. It calculates cash dependency score and cross-checks with digital inflows for a balanced view.

- Regional bank formats Co-operative banks, regional rural banks, or smaller private players use unique PDF layouts, local language headers, or outdated table structures that big-bank tools struggle with. Leading APIs are trained on diverse Indian datasets covering major and regional banks alike. They adapt quickly to lesser-known formats, extracting text and tables accurately without needing custom rules for every bank.

- Scanned and poor-quality PDFs Borrowers often submit branch-printed statements that are photocopied, scanned poorly, or snapped on a phone—skewed, low-contrast, with smudges or missing corners. AI pre-processing (auto-rotation, contrast enhancement, noise removal) combined with robust OCR reads these reliably. It handles multi-page documents, faded text, and even handwritten margin notes, flagging only genuinely unreadable parts for rare manual review.

These solutions mean fewer “upload again” requests, less analyst frustration, and more accurate risk assessment. In 2026, the Best Bank Statement Analyzer API for MSME Lending doesn’t just cope with these challenges—it uses them to deliver a clearer picture of business health than manual methods ever could.

How to Choose the Best Bank Statement Analyzer API

With more options hitting the market in 2026, picking the right bank statement analyzer API for your MSME lending can feel tricky. Not all are built the same—some excel on personal loans but stumble on business accounts. Here’s a straightforward buyer’s checklist most lenders use to cut through the noise and find the best fit.

Accuracy

This is non-negotiable. Test providers with your real mixed statements (scans, regional banks, cash-heavy). Look for high OCR rates (97–99% on poor quality) and strong classification on business inflows, seasonality, and fraud flags. Salary/turnover detection and cash dependency scoring should be spot-on—small errors here directly hit defaults.

MSME-specific features

Generic APIs won’t cut it. You need deep business income identification (merchant settlements, platform payouts), proper separation of personal vs operational flows, seasonality handling, and robust cash flow metrics. Custom rules for your policy (industry thresholds, bounce tolerance) are a must—otherwise you’re forcing your process to fit the tool.

Compliance readiness

RBI rules aren’t optional. Confirm 100% data localization, explicit consent flows, full audit trails, and explainable outputs. Ask for certifications and proof they’ve passed regulatory scrutiny. Weak compliance can shut your digital lending down fast.

Pricing model

Common options: per-statement (₹5–20, with volume discounts), monthly tiers, or enterprise flats. Calculate based on your expected volume—watch for hidden fees (setup, custom rules, overages). Cheaper isn’t always better if lower accuracy means more manual work.

Support & SLAs

Things break—new bank format drops or volume spikes. Look for responsive support (quick tickets, dedicated managers), strong SLAs (99.9% uptime, processing guarantees), and transparent monitoring dashboards. Good documentation and sandbox access speed up integration too.

The smartest move? Shortlist 2–3 that tick your top priorities, run paid pilots on real data, and measure actual impact: turnaround time, approval rates, manual effort saved, and default correlation. The best bank statement analyzer API for you is the one that fits your portfolio, scales with growth, and delivers consistent results without constant babysitting. Take time on evaluation—it’ll pay off for years in profitable MSME lending.

Conclusion

MSME lending in India has huge potential—millions of small businesses need working capital, term loans, or supply chain finance to grow—but it’s held back by slow, manual underwriting that can’t keep up with demand or handle the messy reality of business bank statements.

This guide has shown why automation is no longer optional in 2026. The Best Bank Statement Analyzer API for MSME Lending solves the core problems: it reads poor-quality scans, separates personal from business flows, spots genuine turnover amid irregular credits, detects seasonality and risks, and delivers consistent metrics like average monthly turnover, cash dependency, and bounce frequency—all in minutes instead of days.

The benefits are clear and compounding:

- Lenders get faster approvals, lower operational costs, scalable volume, and sharper risk control—turning MSME books from high-effort/low-margin to real growth drivers.

- Borrowers finally get the quick, hassle-free funding they need to seize opportunities without weeks of waiting.

We’ve looked at how top APIs automate workflows, the must-have features for accurate business assessment. Real use cases across products, compliance essentials, and practical tips for choosing and integrating the right tool.

The future is heading toward predictive, real-time decisions powered by open banking and richer data—but you don’t have to wait for that. The technology is ready today.

My recommendation is straightforward: start evaluating a specialised bank statement analyzer API now. Run a pilot with your actual statements, measure the impact on turnaround time and decision quality, and scale from there. Providers like AZAPI.ai, with their focus on Indian MSME realities—high accuracy, custom rules, strong compliance. And proven scaling—make it easier to get real results fast.

Make the shift, and you’ll be lending to more viable small businesses profitably, efficiently. And at the speed the market demands. 2026 is the year to turn MSME lending into a true competitive advantage. The tools are here—it’s time to use them.

FAQs

1.What is the best bank statement analyzer API for MSME lending?

Ans: The best ones excel at handling irregular business cash flows, mixed accounts, cash-heavy transactions, and seasonality with high accuracy on Indian statements. Look for strong MSME-specific features like turnover estimation, custom rules, and RBI compliance. Providers like AZAPI.ai are popular for their focus on local data and practical customization.

2.How accurate is bank statement analysis for MSME lending?

Ans: Top APIs deliver 97–99% OCR accuracy on real-world scans and PDFs, with 95–98% on transaction classification. For critical MSME tasks like detecting sales credits or cash dependency, accuracy often reaches the high 90s. AZAPI.ai consistently hits 99.91% OCR accuracy on standard Indian statements.

3.Can a bank statement analyzer API detect fake inflows in MSME statements?

Ans: Yes—leading APIs flag fake inflows through pattern checks: round-tripping, sudden spikes, or credits lacking real sales correlation. This helps catch padded turnover early, protecting MSME portfolios from fraud.

4.Is bank statement analysis RBI compliant for MSME lending?

Ans: Reputable APIs are fully compliant with RBI digital lending guidelines, including data localization, consent frameworks, and audit trails. Always confirm the provider’s certifications to avoid risks.

5.How long does MSME bank statement analysis take?

Ans: Most process in 5–30 seconds per statement, supporting near-real-time decisions for working capital or invoice financing. Complex multi-account cases finish under a minute.

6.Is it safe to upload MSME bank statements to an API?

Ans: With trusted providers, yes—strong encryption (AES-256), secure authentication, and auto-deletion policies keep data protected. No human access to raw files unless escalated.

7.Does the best bank statement analyzer API handle scanned or poor-quality statements?

Ans: Yes, advanced pre-processing and OCR make them reliable on blurry mobile photos, faded scans, or multi-page PDFs—common in MSME applications.

8.Can we customize a bank statement analyzer API for our MSME policy?

Ans: Good ones allow custom rules (e.g., turnover thresholds, bounce limits) without heavy development. This ensures the API fits your exact risk appetite.

9.How does AZAPI.ai perform on MSME bank statement accuracy?

Ans: AZAPI.ai achieves 99.91% OCR accuracy across typical Indian business statements, with strong results on classification for turnover, seasonality, and risk signals—making it a reliable choice for high-volume MSME lenders. If you’re evaluating the best bank statement analyzer API options, start with a sandbox trial on your own statements. Tools like AZAPI.ai make it easy to test real impact on speed, accuracy, and defaults before committing.